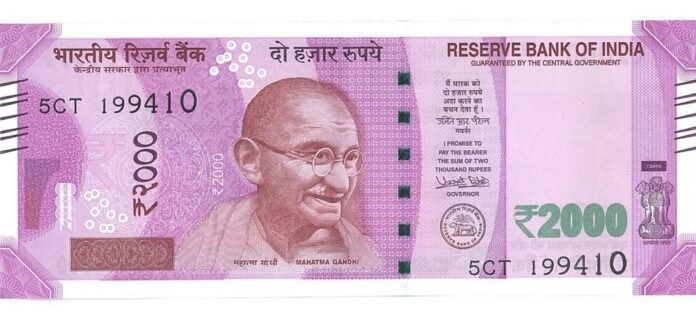

Mumbai: The ₹2000 denomination banknote was launched in November 2016 beneath Part 24(1) of RBI Act, 1934, primarily to satisfy the forex requirement of the economic system in an expeditious method after the withdrawal of authorized tender standing of all ₹500 and ₹1000 banknotes in circulation at the moment.

The target of introducing ₹2000 banknotes was met as soon as banknotes in different denominations turned accessible in satisfactory portions.

Subsequently, printing of ₹2000 banknotes was stopped in 2018- 19. About 89% of the ₹2000 denomination banknotes have been issued previous to March 2017 and are on the finish of their estimated life-span of 4-5 years. The whole worth of those banknotes in circulation has declined from ₹6.73 lakh crore at its peak as on March 31, 2018 (37.3% of Notes in Circulation) to ₹3.62 lakh crore constituting solely 10.8% of Notes in Circulation on March 31, 2023. It has additionally been noticed that this denomination just isn’t generally used for transactions.

Additional, the inventory of banknotes in different denominations continues to be satisfactory to satisfy the forex requirement of the general public. In view of the above, and in pursuance of the “Clear Be aware Coverage” of the Reserve Financial institution of India, it has been determined to withdraw the ₹2000 denomination banknotes from circulation. The banknotes in ₹2000 denomination will proceed to be authorized tender. It could be famous that RBI had undertaken the same withdrawal of notes from circulation in 2013-2014.

Accordingly, members of the general public might deposit ₹2000 banknotes into their financial institution accounts and/or trade them into banknotes of different denominations at any financial institution department. Deposit into financial institution accounts will be made within the regular method, that’s, with out restrictions and topic to extant directions and different relevant statutory provisions.

As a way to guarantee operational comfort and to keep away from disruption of normal actions of financial institution branches, trade of ₹2000 banknotes into banknotes of different denominations will be made upto a restrict of ₹20,000/- at a time at any financial institution ranging from Might 23, 2023.

To finish the train in a time-bound method and to supply satisfactory time to the members of public, all banks shall present deposit and/or trade facility for ₹2000 banknotes till September 30, 2023. Separate guidelines have been issued to the banks.

The ability for trade of ₹2000 banknotes upto the restrict of ₹20,000/- at a time shall even be offered on the 19 Regional Places of work (ROs) of RBI having Problem Departments1 from Might 23, 2023.

The Reserve Financial institution of India has suggested banks to cease issuing ₹2000 denomination banknotes with fast impact. 11. Members of the general public are inspired to utilise the time as much as September 30, 2023 to deposit and/or trade the ₹2000 banknotes. A doc on Frequently Asked Questions (FAQs) within the matter has been hosted on the RBI web site for info and comfort of the general public.

For Extra Newest Information Comply with @XpertTimes