New Delhi : Index provider, MSCI, has announced changes to its designation of Adani Group securities following feedback from various market participants. The changes, including adjustments to market capitalization determinations, will be revealed as part of its regular February review. MSCI stated that some investors have too much uncertainty to be considered as “free float” in accordance with its methodology. The term “free float” refers to the portion of outstanding shares that can be purchased by international investors in the public equity markets.

In its February Index Review, MSCI will temporarily halt any potential changes to the number of shares (NOS) for the impacted securities. Furthermore, the company will review the handling of non-neutral corporate events on a case-by-case basis, potentially deferring their implementation until announced to clients through regular index announcements. Neutral corporate events, however, will continue to be implemented, including those that require a Price Adjustment Factor.

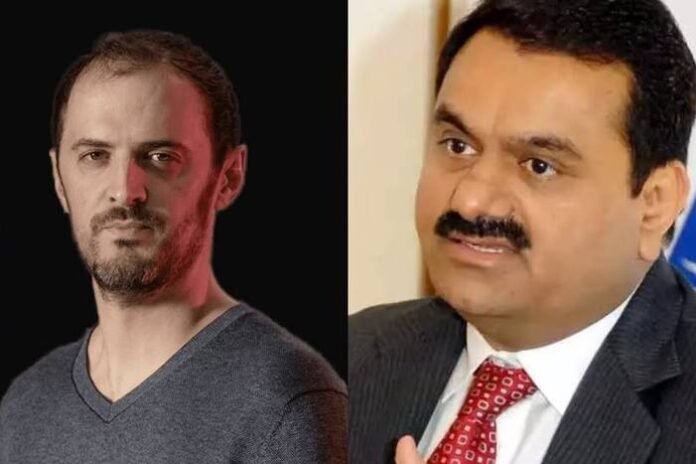

Nate Anderson, founder of Hindenburg Research, sees the changes as validation of the company’s findings on Adani’s offshore stock parking.